Different types are gifts are given for the furtherance of business. Advertising for your business.

You cant claim gifts or donations that provide you with a personal benefit.

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

. What you cant claim. The types of gift can include skincare and beauty products flowers wine perfumes gift vouchers and hampers. With that said though if the cost of Christmas gifts given to an individual be they your staff member or a client exceeds 50 VAT included in a 12-month.

With the implementation of GST the term gift has become a buzzword. Make gifts of goods or services. The hampers given to the two departments are regarded as a gift of goods to Customer B.

The gift cant be food drink tobacco or a tokenvoucher exchangeable for goods. An item given away to the general public in order to advertise your business for example a free sample. The 50 is an.

Gifts may be branded gifts or unbranded gifts festival gifts or promotional incentive gifts. Due to Section 17 5 it is so stipulated that no ITC on any goods can be availed if they are given as gifts whether or not in course. Give away goods which are samples of their supplies.

If you are giving out gift baskets or hampers and some of the contents are food or drink but not all the food or drink items are 50 deductible but the other gift items are 100 deductible. PWC - Christmas gifts could be illegal under Bribery Act Just a general point as the limit mentioned in lja20s original post was below the 50 limitCorporate Christmas gifts of a gold fountain pen or a case of Champagne may be caught by the new Bribery Act according to a Serious Fraud Office Secret Father Christmas test drawn up by the countrys largest. If this limit is exceeded and input tax is reclaimed VAT will need to be accounted for on the value of the gift.

4 Top Tips for Landlords. The gift must not be alcohol food tobacco or vouchers that can be exchanged for those things. HMRC will allow you to give a business gift worth up to 50 to any one person in any one tax year.

The gift must contain your business logo or branding otherwise it will fall into entertainment which is not tax allowable. Clause h of Section 17 5 deals with ITC on gifts. On the subject of VAT businesses can claim the input VAT on gifts given to staff members and clients only and not those bought for themselves their family associates or friends.

1500 for contributions and gifts to independent candidates and members. Festive occasions such as Chinese New Year Hari Raya Deepavali and Christmas cash non-cash The gifts eg. An item that includes a conspicuous advertisement for your business - though this must cost less than 50 and not be part of a series of.

It is unlikely to be accepted as tax deductible. Are involved in business promotion. Business diary and must not be food alcoholic drink or tobacco or vouchers which are exchangeable for food drink or tobacco.

Input VAT can be reclaimed on the cost of business gifts. If you had claimed the GST of 21 incurred on the hampers as input tax you will need to account for output tax of 21 ie. GST and Gifts to Clients.

If youre self-employed you dont have to report or pay tax or National Insurance on personal gifts eg birthday or wedding presents that you give to employees. As per GST laws the employer and employee are deemed to be related persons. The value of such a gift or series of gifts to one person cannot exceed 50 in an accounting period if it is to be allowable.

In Section 17 5 of the CGST Act it deals with blocked credit. The gift must be a business gift eg. This notice is intended for businesses who.

A tax deduction and GST credit can also be claimed. 50000 shall not be considered as Supply. As a guide a gift not exceeding 200 is considered to be not substantial in value.

Output VAT is accounted for when business gifts are made to the same person and the total cost of all the gifts exceeds 50 in any 12-month period. To claim a deduction you must have a written record of your donation. If you follow a few simple rules you will be able to get tax relief on your businesses Christmas gifts to clients suppliers.

To reward customers or to support a local charity. VAT is recoverable on such business gifts and output VAT does not need to be accounted for as long as the total value of all gifts does not exceed 50 excluding VAT given to the same person in any 12 month period. This means that a similar gift can also be provided to a spouse or partner of the staff.

Customer Gifts Costing More Than 50. As such supply of any goods or services by employer to employee without consideration shall be treated as Supply according to Schedule-I of CGST Act 2017. The VAT on any.

The credit is restricted on any goods disposed off by way of gift and not eligible for ITC. The definition of business gifts includes items from brochures posters and advertising matters gifts to trade customers long service awards and retirement awards and goods given to customers as a thank you. Business gifts to clients.

All you need to do is fill out a simple form and we will handle the rest. Output tax will be payable when you make the gift unless the VAT-exclusive value of the gift and the total value of all gifts made to the same person in the previous twelve months is less than 50 in total. But it is also provided that gifts not exceeding value of Rs.

7 of 300 since the cost of the gift is more than 200. Staff Uniforms and the National Minimum Wage. As we are registered tax agents we are able to ensure that your registration has been completed correctly before we.

The gifts are provided by the company for the purpose of advancement of business or for sales promotion. 1500 for contributions and gifts to political parties. Red packets during Chinese New Year are not taxable if they are not substantial in value and are generally available to all staff.

You can obtain a tax deduction for the following business gifts. A business logo would be perfect for this but make sure the. Where the total cost of business gifts given to the same person in any 12-month period exceeds 50 and the business was entitled to claim VAT.

However if you chose not to claim the GST incurred on the hampers you. However you can claim input tax on the purchase of goods where they are given away for business motives eg. Gifts to business customers are tax allowable however they must meet certain conditions as set out by HMRC.

The gift must carry a conspicuous advertisement for. 13 Who should use this notice. The rule of thumb with gifts is that if they consist of food or drink you can only claim 50 of the expense as a tax deduction.

VAT is either irrecoverable or if recovered an output VAT charge must be accounted for. To claim GST credits on any purchase even those with a gift card you must be registered for GST. Tax On Buy-to-let Property.

The most you can claim in an income year is. The gift itself must carry an advertisement for your business. The 300 minor benefits exemption also separately applies to any gifts provided to associates.

Direct Payment Of Medical Expenses And Tuition As An Exception To The Gift Tax The American College Of Trust And Estate Counsel

Rs 170 Crore Of Jammu Industrialists Pending With Union Government Tax Refund Goods And Services Refund

How To Get Gst Tax Refund Before Leaving Singapore Changi Airport Or Cruise Terminal Understand What Is Gst Sal Singapore Changi Airport Singapore Travel Tips

The Generation Skipping Transfer Tax A Quick Guide

Acrylic To Do List Board For Wall Family Command Center Dry Etsy In 2022 Family Command Center Office Decor Command Center

Tupperware Warranty Warranty Tupperware Self

Treatment Of Free Samples Supplies And Gifts Under Gst Regime

Employee Gifts What Are The Tax Implications Of Giving Gifts To Staff Blog Avalon Accounting

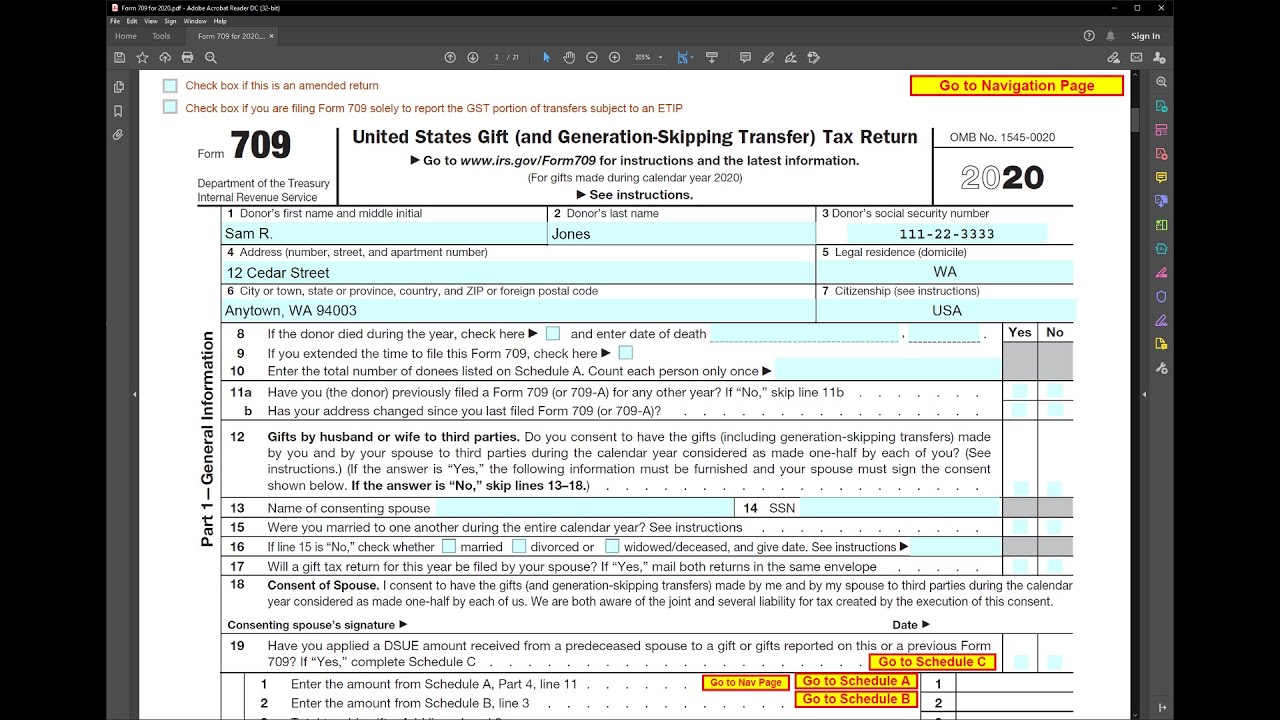

Irs Form 709 Gift And Gst Tax Youtube

Issue Faced While Filing Gstr9c Form And Their Possible Solutions Https Www Mastersindia Co Gst Gs Income Tax Return Income Tax Return Filing Indirect Tax

Input Tax Credit On Diwali Gifts Other Promotional Items

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Soccer Dad Mug Soccer Dad Gift Gift For Soccer Dad Soccer Fan Mug Soccer Fan Gift Soccer Coach Mug Soccer Soccer Dad Soccer Fan Gifts Soccer Coach Gifts

Are Gifts To Your Employees Clients And Suppliers Claimable As A Business Expense

The Generation Skipping Transfer Tax A Quick Guide